The Reserve Bank of India (RBI) on September 7 announced a special round of simultaneous sale and purchase of government securities (G-Secs) for Rs 10,000 crore each, on September 10, 2020.

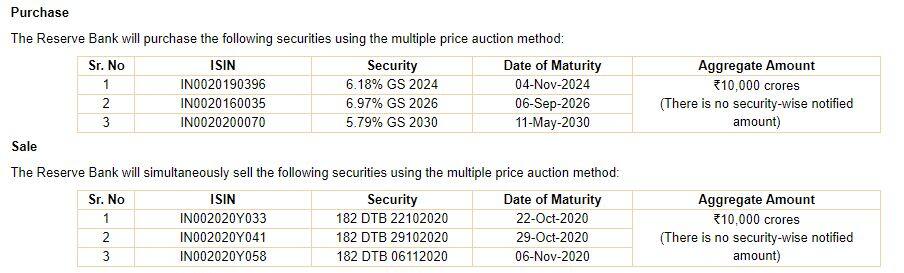

It has released details of the sale and purchase of securities, which will be done using the multiple price auction method.

The result of the auctions will be announced on the same day and successful participants are required to ensure availability of funds or securities in their current/SGL accounts, as the case may be, by noon on September 11.

The central bank reserves the right to decide on the quantum of purchase or sale of individual securities, accept bids for less than the aggregate amount, purchase or sell marginally higher or lower than the aggregate amount due to rounding-off, and accept or reject any or all the bids either wholly or partially without assigning any reasons.

The RBI had earlier on August 25 announced its decision to conduct special open market operations (OMOs) involving the simultaneous sale and purchase of government securities for an aggregate Rs 20,000 crore in two tranches of Rs 10,000 crore each. The auctions were conducted on August 27 and September 3.

It had also said that in order to continue to ensure orderly market conditions and congenial financial conditions, it would conduct additional special OMO involving simultaneous purchase and sale of government securities for an aggregate amount of Rs 20,000 crore in two tranches of Rs 10,000 crore each. The auctions would be conducted on September 10, 2020 and September 17, 2020.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!